Accelerating Your Business Growth with

Cutting-Edge Digital Business Solutions

LET’S TALK

Augmenting Your Business Growth with

Groundbreaking A.I.

LET’S TALK

Bringing Revolutionary Ideas to Reality with

Mobile Application

LET’S TALK

Accelerating Your Business Growth with

Cutting-Edge Digital Business Solutions

LET’S TALK

Augmenting Your Business Growth with

Groundbreaking A.I.

LET’S TALK

Bringing Revolutionary Ideas to Reality with

Mobile Application

LET’S TALK

Accelerating Your Business Growth with

Cutting-Edge Digital Business Solutions

LET’S TALK

4.5/5

5/5

100% on time | 100% customer satisfaction.

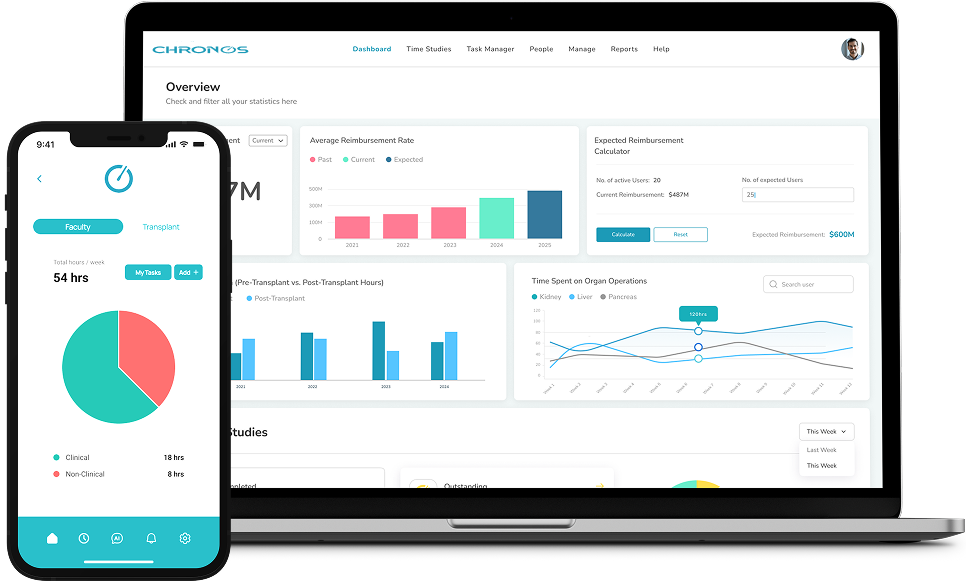

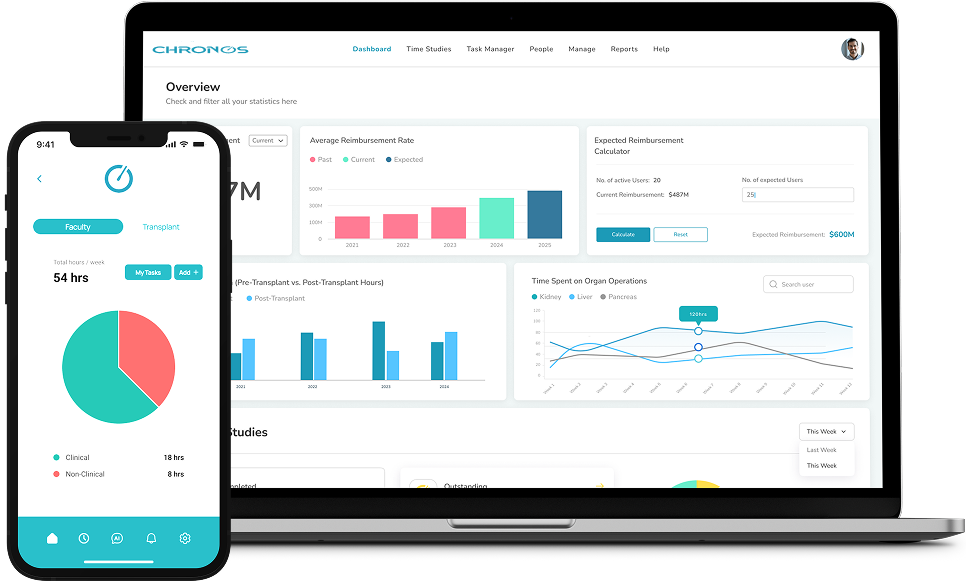

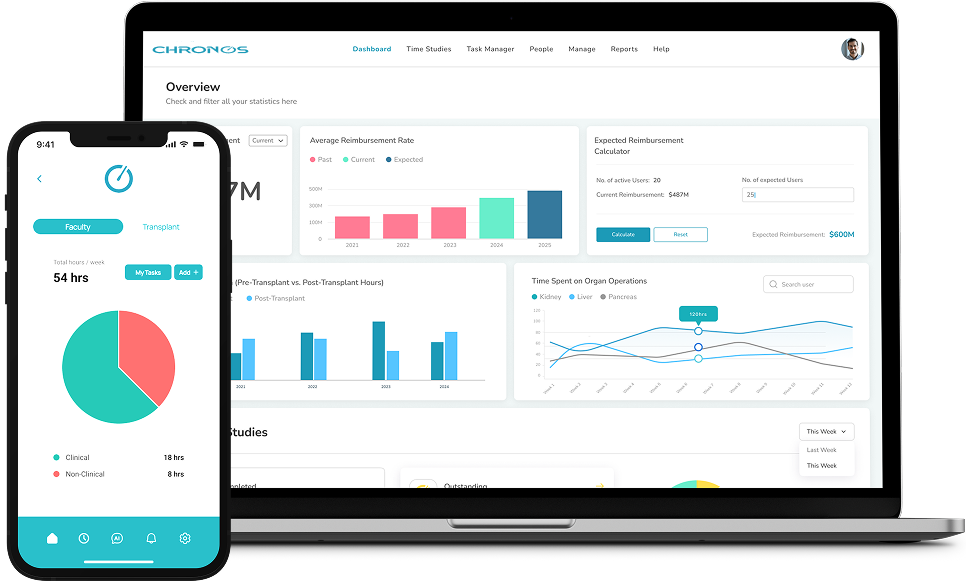

Solving Complex Problems in

Healthcare withAI

Maximize your Medicare/Medicaid ROI With a Powerful & Affordable PlatformFor businesses who need clarity, productive communication, prioritisation and accountabilityLearn more

Maximize your Medicare/Medicaid ROI With a Powerful & Affordable PlatformFor businesses who need clarity, productive communication, prioritisation and accountabilityLearn more

Improving quality of Life and Increasing Life Longevity for Elderly.Provides the perfect solution for seniors living in the USA or all over the globe with little to no assistance.Learn more

Improving quality of Life and Increasing Life Longevity for Elderly.Provides the perfect solution for seniors living in the USA or all over the globe with little to no assistance.Learn more

Revolutionizing Healthcare Data Exchange with DOCLINQA cutting-edge healthcare platform that streamlines patient care with AI-driven appointment scheduling, intelligent risk assessment, and seamless medical data management.Learn more

Revolutionizing Healthcare Data Exchange with DOCLINQA cutting-edge healthcare platform that streamlines patient care with AI-driven appointment scheduling, intelligent risk assessment, and seamless medical data management.Learn more

Healthcare Transportation. Reimagined.Reimagining the medical transportation ecosystem with out-of-the box thinking.Learn more

Healthcare Transportation. Reimagined.Reimagining the medical transportation ecosystem with out-of-the box thinking.Learn more

Maximize your Medicare/Medicaid ROI With a Powerful & Affordable PlatformFor businesses who need clarity, productive communication, prioritisation and accountabilityLearn more

Maximize your Medicare/Medicaid ROI With a Powerful & Affordable PlatformFor businesses who need clarity, productive communication, prioritisation and accountabilityLearn more

Improving quality of Life and Increasing Life Longevity for Elderly.Provides the perfect solution for seniors living in the USA or all over the globe with little to no assistance.Learn more

Improving quality of Life and Increasing Life Longevity for Elderly.Provides the perfect solution for seniors living in the USA or all over the globe with little to no assistance.Learn more

Revolutionizing Healthcare Data Exchange with DOCLINQA cutting-edge healthcare platform that streamlines patient care with AI-driven appointment scheduling, intelligent risk assessment, and seamless medical data management.Learn more

Revolutionizing Healthcare Data Exchange with DOCLINQA cutting-edge healthcare platform that streamlines patient care with AI-driven appointment scheduling, intelligent risk assessment, and seamless medical data management.Learn more

Healthcare Transportation. Reimagined.Reimagining the medical transportation ecosystem with out-of-the box thinking.Learn more

Healthcare Transportation. Reimagined.Reimagining the medical transportation ecosystem with out-of-the box thinking.Learn more

Maximize your Medicare/Medicaid ROI With a Powerful & Affordable PlatformFor businesses who need clarity, productive communication, prioritisation and accountabilityLearn more

Maximize your Medicare/Medicaid ROI With a Powerful & Affordable PlatformFor businesses who need clarity, productive communication, prioritisation and accountabilityLearn more

Highly Experienced Teams

100000+

SATISFIED USERS OF OUR PRODUCTS

100+

YEARS OF COMBINED EXPERIENCE

Cutting-Edge Technology

Services Under One Roof!

Services we can provide:

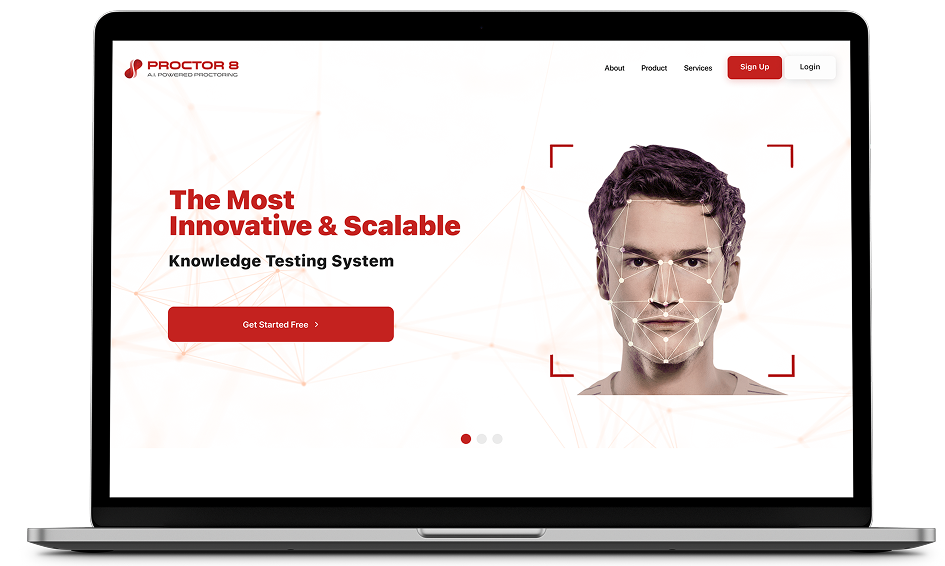

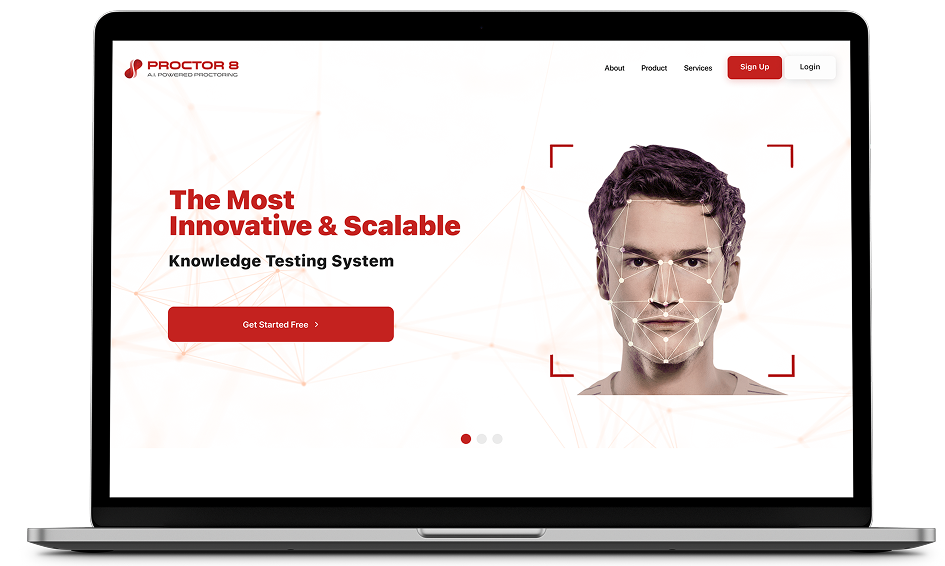

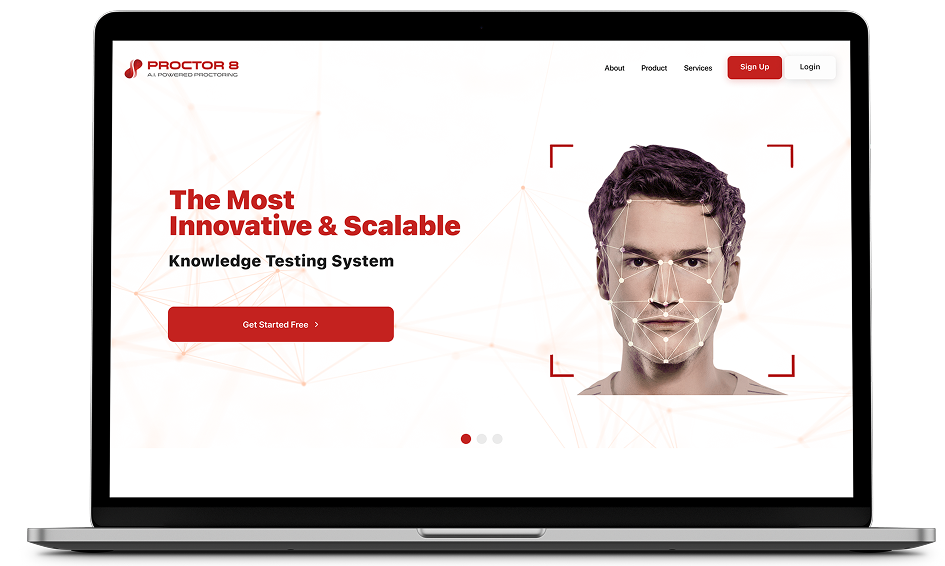

Proctor8- The Most Innovative & ScalableProctor8 is a fully cloud-based platform that provides end-to-end proctoring services.Learn more

InteRoads - Most Advanced & Powerful Automated Testing SystemInteRoads is the industry’s most advance, intuitive, and powerful automated knowledge and road testing platform.Learn more .37810c4c.png)

KTS- Knowledge Testing Solutions KTS lets you run unlimited tests in any language across all locations — all from one simple dashboard. Sign up now for your 30-day free trial!Learn more

Proctor8- The Most Innovative & ScalableProctor8 is a fully cloud-based platform that provides end-to-end proctoring services.Learn more

InteRoads - Most Advanced & Powerful Automated Testing SystemInteRoads is the industry’s most advance, intuitive, and powerful automated knowledge and road testing platform.Learn more .37810c4c.png)

KTS- Knowledge Testing Solutions KTS lets you run unlimited tests in any language across all locations — all from one simple dashboard. Sign up now for your 30-day free trial!Learn more

Proctor8- The Most Innovative & ScalableProctor8 is a fully cloud-based platform that provides end-to-end proctoring services.Learn more

Code Snippets.

Introducing Simple Interval Reminder/Timer Chrome extension!Are you looking for an easy way to set reminders or timers while you browse the web? Look no further! Our extension is designed to help you stay organized and on track with your tasks.Learn more

Introducing the AI Tweet Generator BotIntroducing the AI Tweet Generator Bot, your ultimate tool for crafting captivating and engaging tweets! Powered by cutting-edge artificial intelligence technology, this bot is designed to assist users in generating high-quality tweets effortlessly.Learn more

.57c3d0b5.png)

Introducing the AI Upwork Proposal Generator Botis a powerful Chrome extension designed to assist freelancers in crafting compelling proposals on the Upwork platform. Leveraging the capabilities of artificial intelligence, this extension generates customized proposals by analyzing job descriptions and generating relevant proposal content.Learn more

Introducing Simple Interval Reminder/Timer Chrome extension!Are you looking for an easy way to set reminders or timers while you browse the web? Look no further! Our extension is designed to help you stay organized and on track with your tasks.Learn more

Introducing the AI Tweet Generator BotIntroducing the AI Tweet Generator Bot, your ultimate tool for crafting captivating and engaging tweets! Powered by cutting-edge artificial intelligence technology, this bot is designed to assist users in generating high-quality tweets effortlessly.Learn more

.57c3d0b5.png)

Introducing the AI Upwork Proposal Generator Botis a powerful Chrome extension designed to assist freelancers in crafting compelling proposals on the Upwork platform. Leveraging the capabilities of artificial intelligence, this extension generates customized proposals by analyzing job descriptions and generating relevant proposal content.Learn more

Introducing Simple Interval Reminder/Timer Chrome extension!Are you looking for an easy way to set reminders or timers while you browse the web? Look no further! Our extension is designed to help you stay organized and on track with your tasks.Learn more

Schedule your free consultancy today.

Cutting Edge Labor

Market Solutions

The #1 Job Board for Hiring or Finding your next jobCareer.VI is the Virgin Islands' #1 Job website. This great platform allows Virgin Islands employers to post their job openings absolutely free. If you are looking for jobs in St. Croix, St. Thomas, St John, Tortola, Virgin Gorda, Anegada, Jost Van Dyke and Caribbean Jobs, Career.VI provides you one stop resource to find and apply for all USVI and BVI jobs.

Make Better Decisions with 360 InsightNinjaHR is built to meet the changing needs of HR for small to growing teams. Our cloud-based HR system grows with your needs without breaking your wallet. Elevate your HR, simplify your processes, get 360 insight and retain best talent with Ninja HR.

The #1 Job Board for Hiring or Finding your next jobCareer.VI is the Virgin Islands' #1 Job website. This great platform allows Virgin Islands employers to post their job openings absolutely free. If you are looking for jobs in St. Croix, St. Thomas, St John, Tortola, Virgin Gorda, Anegada, Jost Van Dyke and Caribbean Jobs, Career.VI provides you one stop resource to find and apply for all USVI and BVI jobs.

Make Better Decisions with 360 InsightNinjaHR is built to meet the changing needs of HR for small to growing teams. Our cloud-based HR system grows with your needs without breaking your wallet. Elevate your HR, simplify your processes, get 360 insight and retain best talent with Ninja HR.

The #1 Job Board for Hiring or Finding your next jobCareer.VI is the Virgin Islands' #1 Job website. This great platform allows Virgin Islands employers to post their job openings absolutely free. If you are looking for jobs in St. Croix, St. Thomas, St John, Tortola, Virgin Gorda, Anegada, Jost Van Dyke and Caribbean Jobs, Career.VI provides you one stop resource to find and apply for all USVI and BVI jobs.

Contact Us.

Talk to us and

get your project moving!

We will respond to you within 24 hours.

You’ll be talking to product and tech experts (no account managers).

Areas We Serve

Lahore

Hally Tower

Pakistan

Boston

100 Powdermill road, Suit 127, Acton MA 01720

USA

Lahore

Hally Tower

Pakistan

Boston

100 Powdermill road, Suit 127, Acton MA 01720

USA

Lahore

Hally Tower

Pakistan